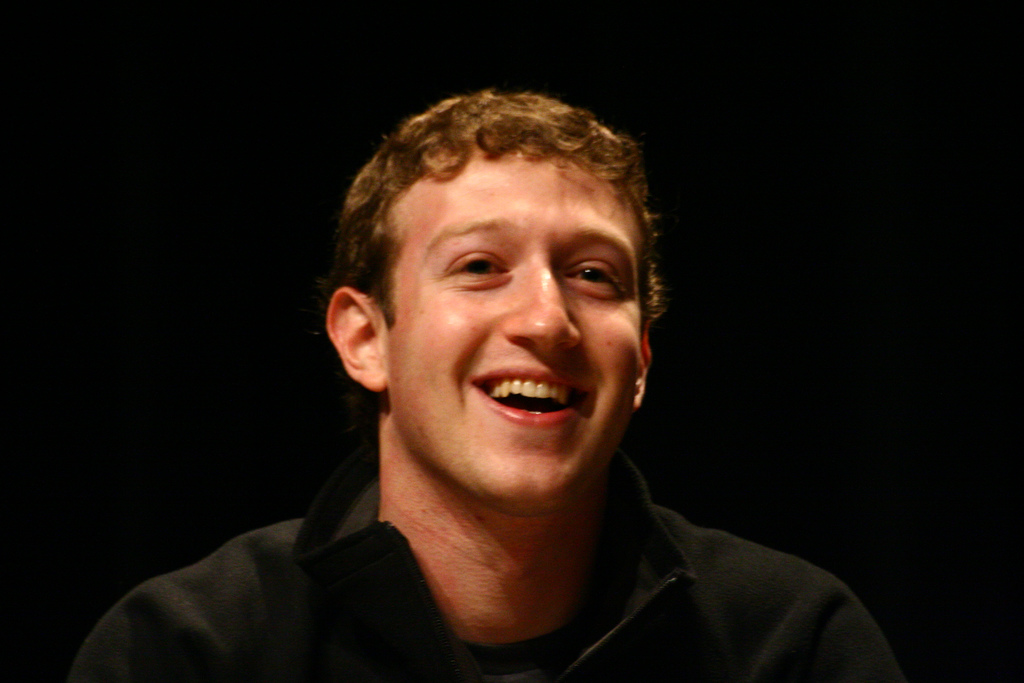

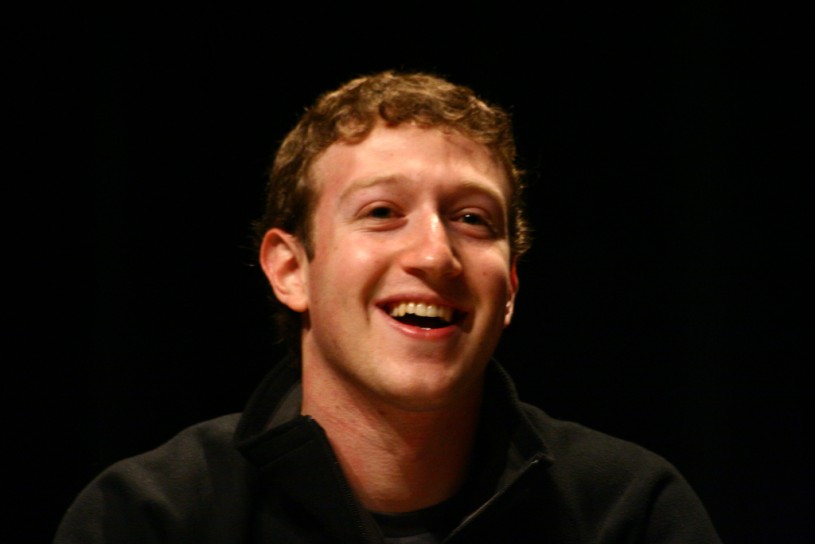

(Image: Jason McELweenie / Flickr)

Depressed global markets in recent months have taken their toll on the world’s billionaires, as cheap oil and China’s fledgling economy have shrunk investments. That is, unless your name is Mark Zuckerberg.

The Facebook founder saw his wealth jump by $5 billion since September, from $45 to $50 billion driven by the high returns of his company. The wealth of those at the very top changes daily—the Bloomberg Billionaire List lists him at fifth as of February 4th. For a moment, he was ranked fourth according to Bloomberg Business.

In either case, his wealth his rising steadily despite the global slump.

Zuck also has something his ultra-wealthy contemporaries at the top don’t have and, a rarity for them, can’t buy: youth. At 31 he is half the age of the four wealthiest people currently ahead of him on the global list—Bill Gates, Amancio Ortega, and Warren Buffett, and Carlos Slim.

With a four or five decades left to go, it’s reasonable to assume Zuckerberg’s wealth will continue to rise, bringing up a question Inequality.org contributor Bob Lord has wondered—could he be the first trillionaire?

If the trends in wealth concentration persist, Lord argues, it’s simply a matter of time before someone breaks thirteen digits. And with Zuckerberg’s age, he’s got the most time for the concentration to play out.

The cable network CNBC made a similar argument in a 2014 article titled “Will there be a trillionaire in the 21st century?” They point to Tesla founder Elon Musk as another frontrunner in the race to a trillion given his multiple successful ventures.

It’s possible that Zuckerberg’s philanthropy will prevent him from hitting the big T. Much newspaper ink was splashed covering his announcement late last year to give away 99 percent of his money over his lifetime.

However, as I argued in The New York Times, Zuckerberg’s latest philanthropic venture does not prevent him from maintaining full control over his immense fortune. And if Bill Gates is any indication, even earnest philanthropy doesn’t prevent wealth from concentrating at a record clip.

It’s also possible that no one makes it to a trillion dollars. As Bob Lord pointed out, it is in fact quite morbid to consider one person holding that much financial power. Perhaps a serious tax overhaul and a closure of offshore tax havens will end the current wealth hoarding of those at the top. Time will tell.