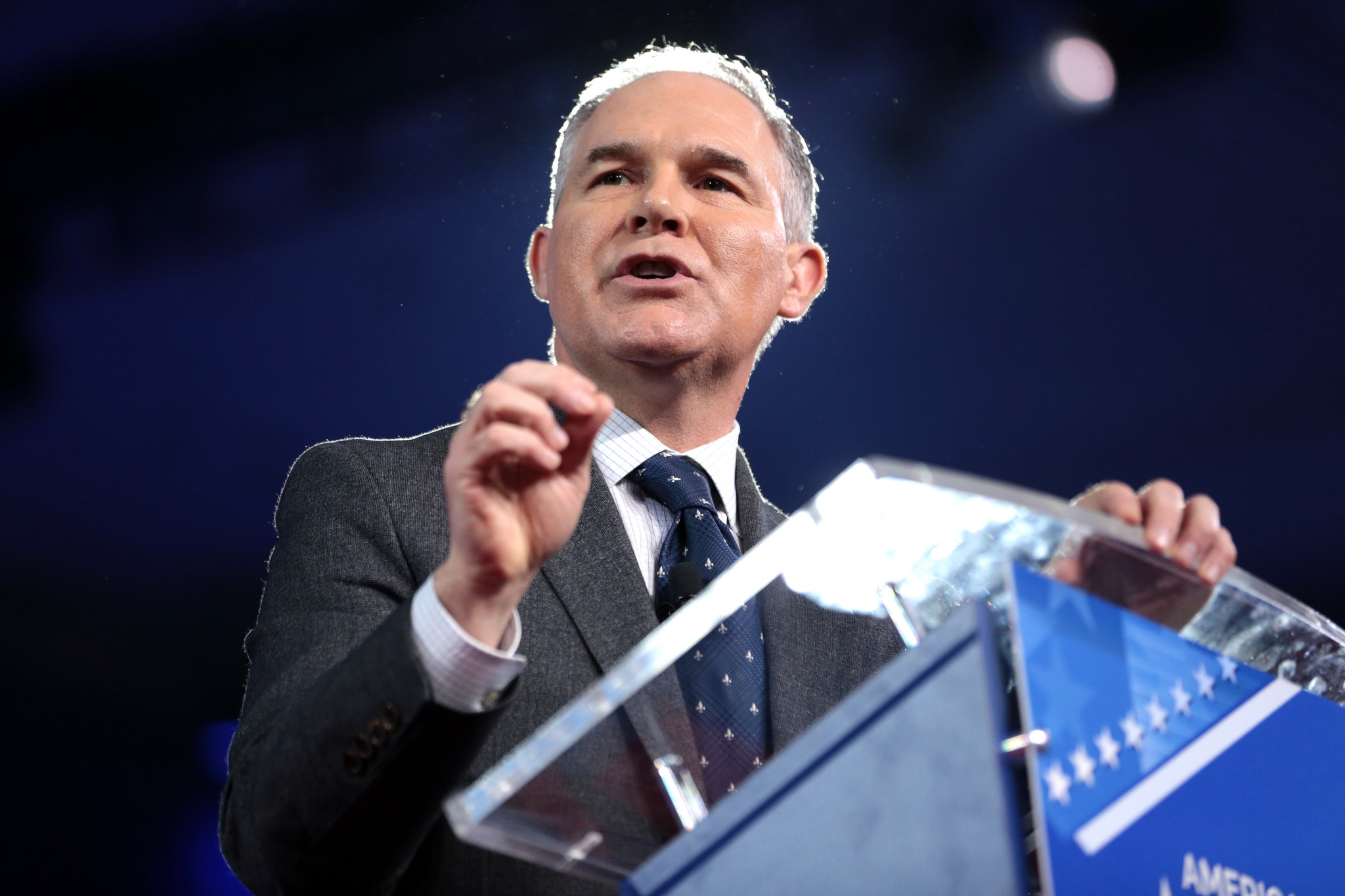

Will Greed Be the EPA Leader’s Downfall?

Activists are hoping to use Scott Pruitt’s self-enrichment at taxpayer expense to get rid of a dangerous climate change denier.

Activists are hoping to use Scott Pruitt’s self-enrichment at taxpayer expense to get rid of a dangerous climate change denier.

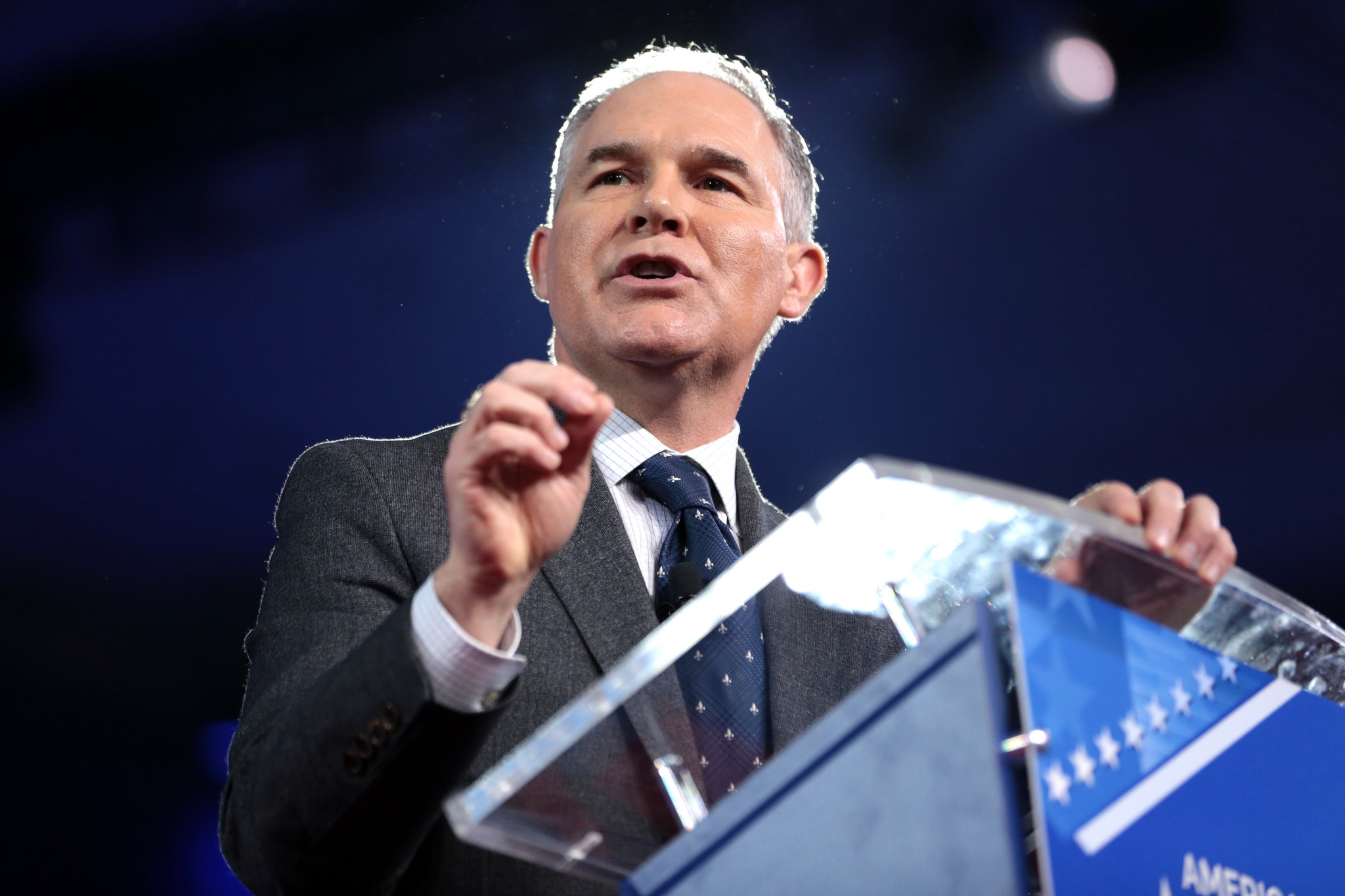

Charities are increasingly reliant on larger donations from a smaller number of high net-worth donors.

This is not about Israeli defenses, Bennis told the Real News Network, it’s about funding apartheid.

The late pop star eschewed tax-dodging chicanery and will still leave a sizable fortune to his heirs—as well as to the taxpayers who helped him succeed.

Underfunding the IRS helps the very wealthy at the expense of the middle and working class. So why do we do it?

The Buckeye State has reformed its juvenile justice system because it understands that “children have to be treated like children.”

A call to boycott the tax preparation companies spending millions making sure the tax code is overly complex.

New data provides a glimpse into the lives of the richest of rich—how the 400 highest earners make their money and pay their taxes.

New report shows that while restaurant executives are fighting living wages for their workers, they’re also benefiting from tax subsidies for their own pay.

A new report reveals that fast food companies are pocketing massive taxpayer subsidies for CEO pay while working to keep low-level workers’ wages so low that many must rely on public assistance.

Council Members take notice: The people want taxes on the wealthy to be raised.

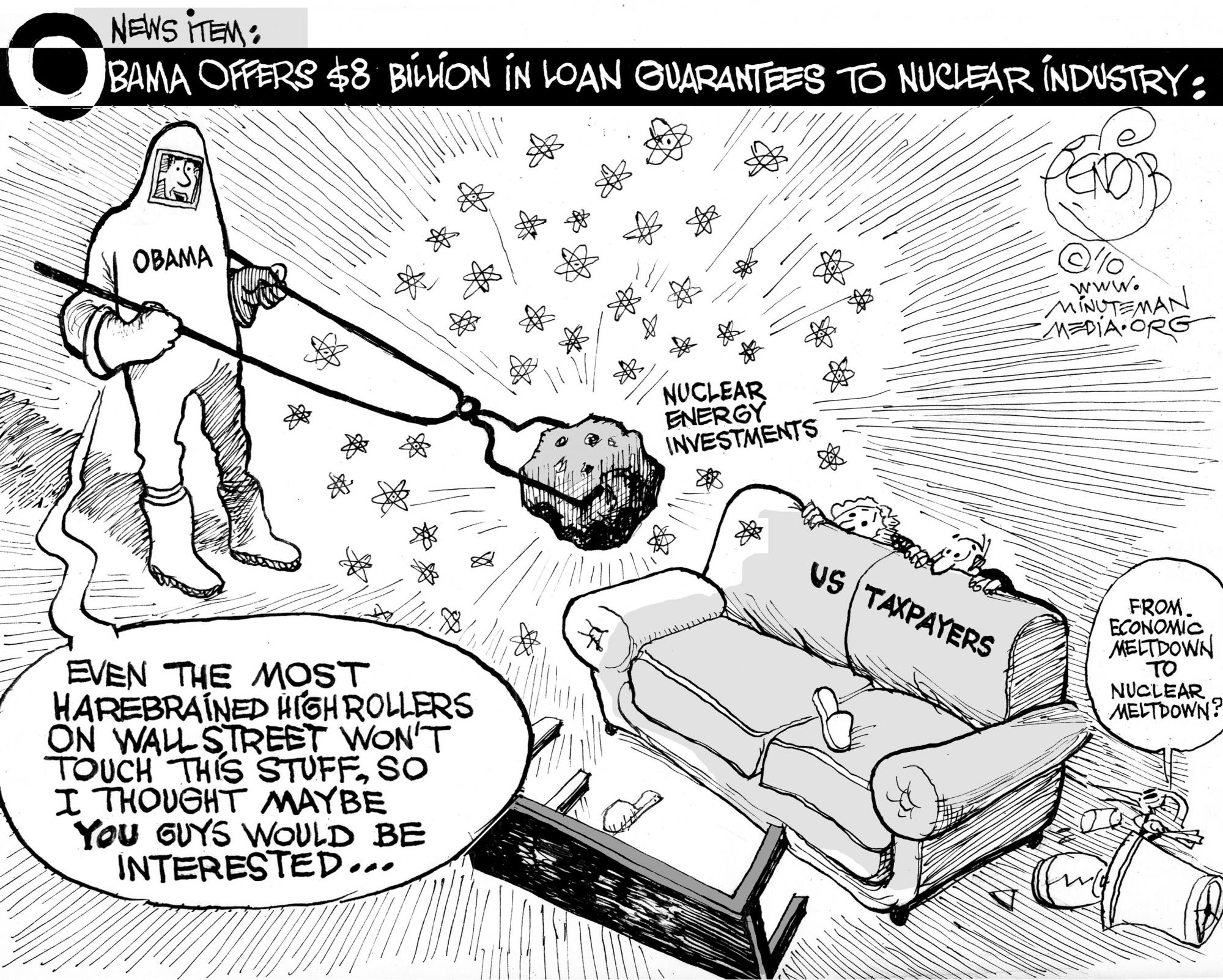

If the nuclear industry is a solid investment, then it should be able to receive the backing of Wall Street.