Cancel Student Loan Debt. Bail Out Regular People.

Even writing off every penny of student debt would cost less than Trump’s tax giveaways for corporations and the rich.

Even writing off every penny of student debt would cost less than Trump’s tax giveaways for corporations and the rich.

Working families are turning their anger at Wall Street into action.

From Athens to Tehran, powerful countries make the rules and break the rules. Everyone else just squeezes the best deal they can — for now, anyway.

Despite Cyprus’ small size, the implications of its bailout deal deal could have serious consequences for the eurozone.

The Spanish bailout is yet another witches brew of cutbacks, layoffs, and austerity.

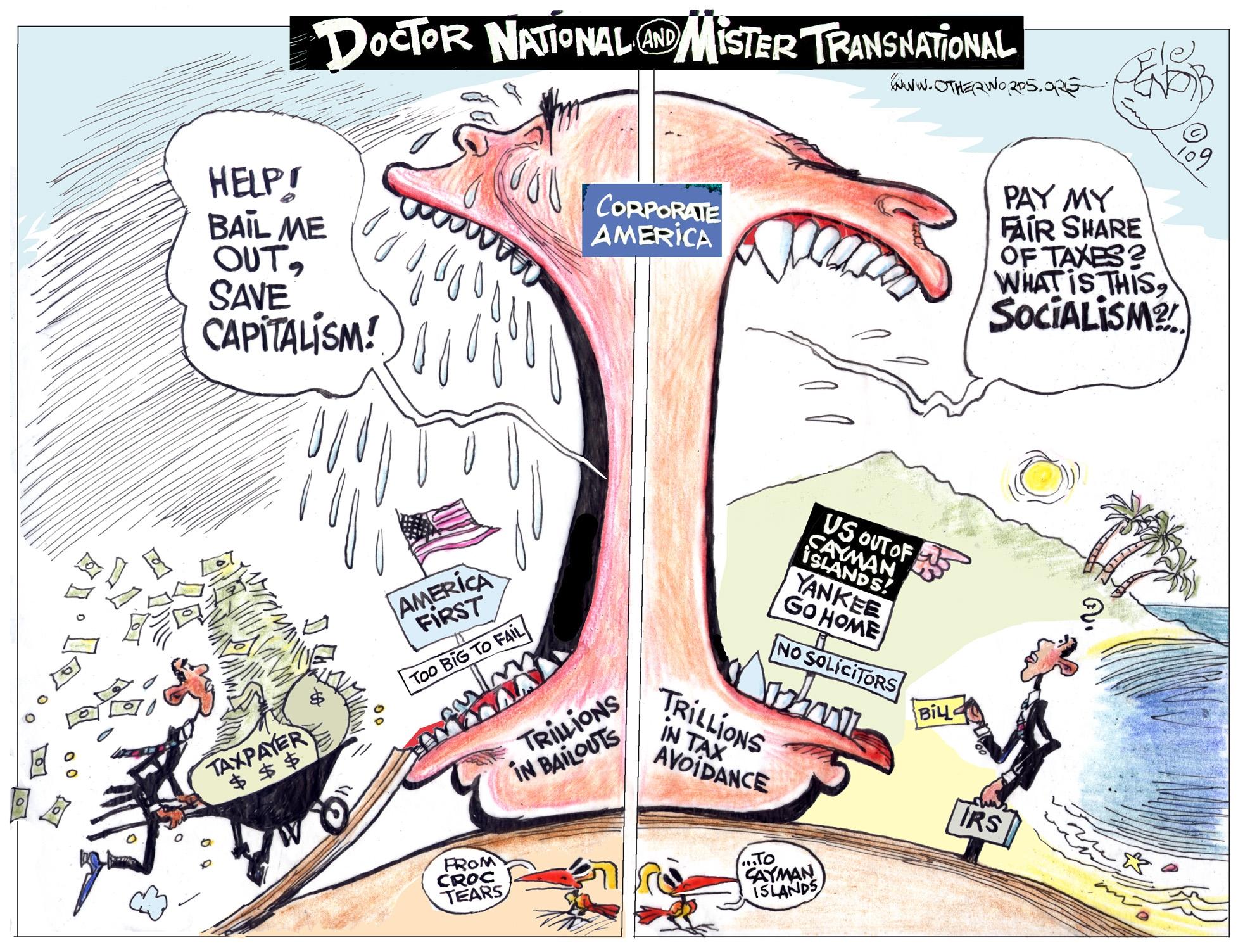

Pay my fair share of taxes? What is this, socialism?

If Spain and Italy are forced to apply for bailouts, it is not clear the European Union or the euro would survive.

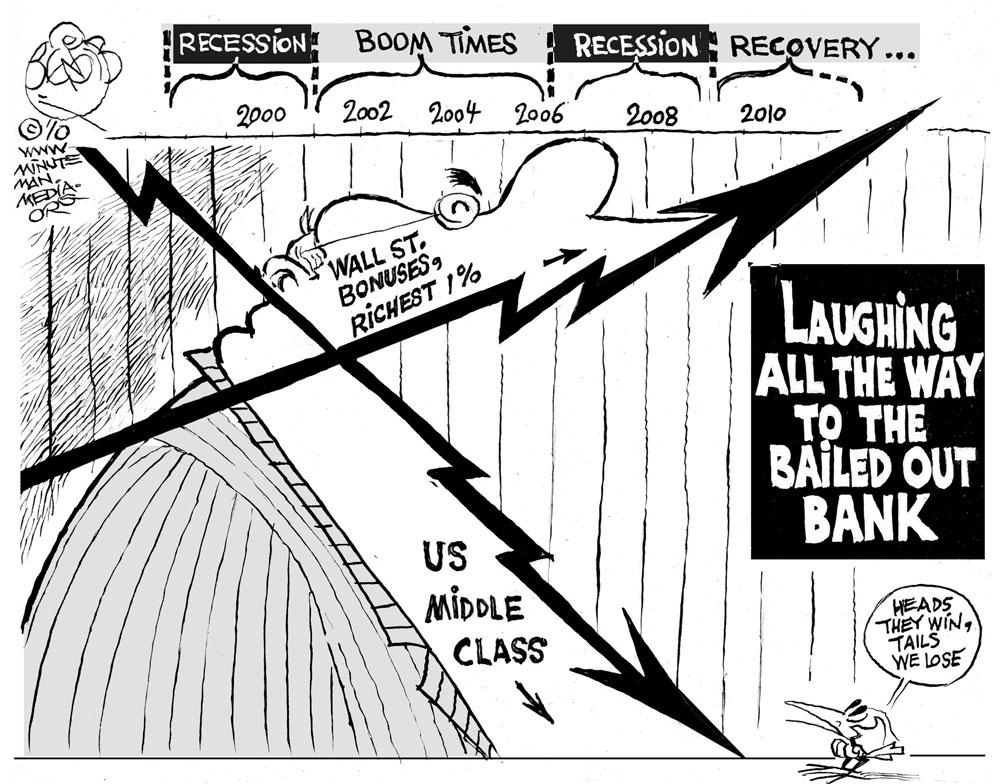

Laughing all the way to the bailed-out bank.

Is the administration really curbing bloated CEO pay?

Wall Street might be bouncing back, but what about the rest of us?

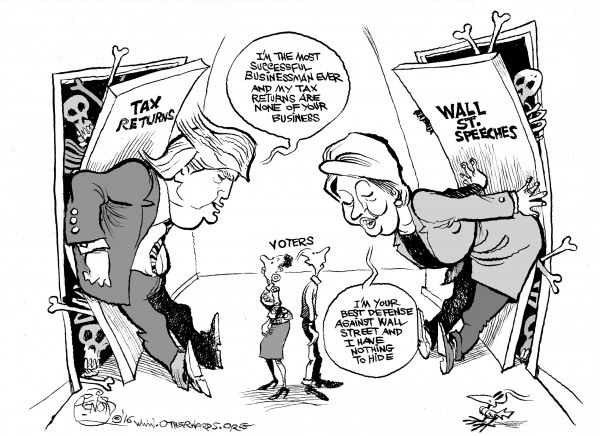

We’re pointing fingers at President Obama — when those responsible for the economic crisis escape blame.

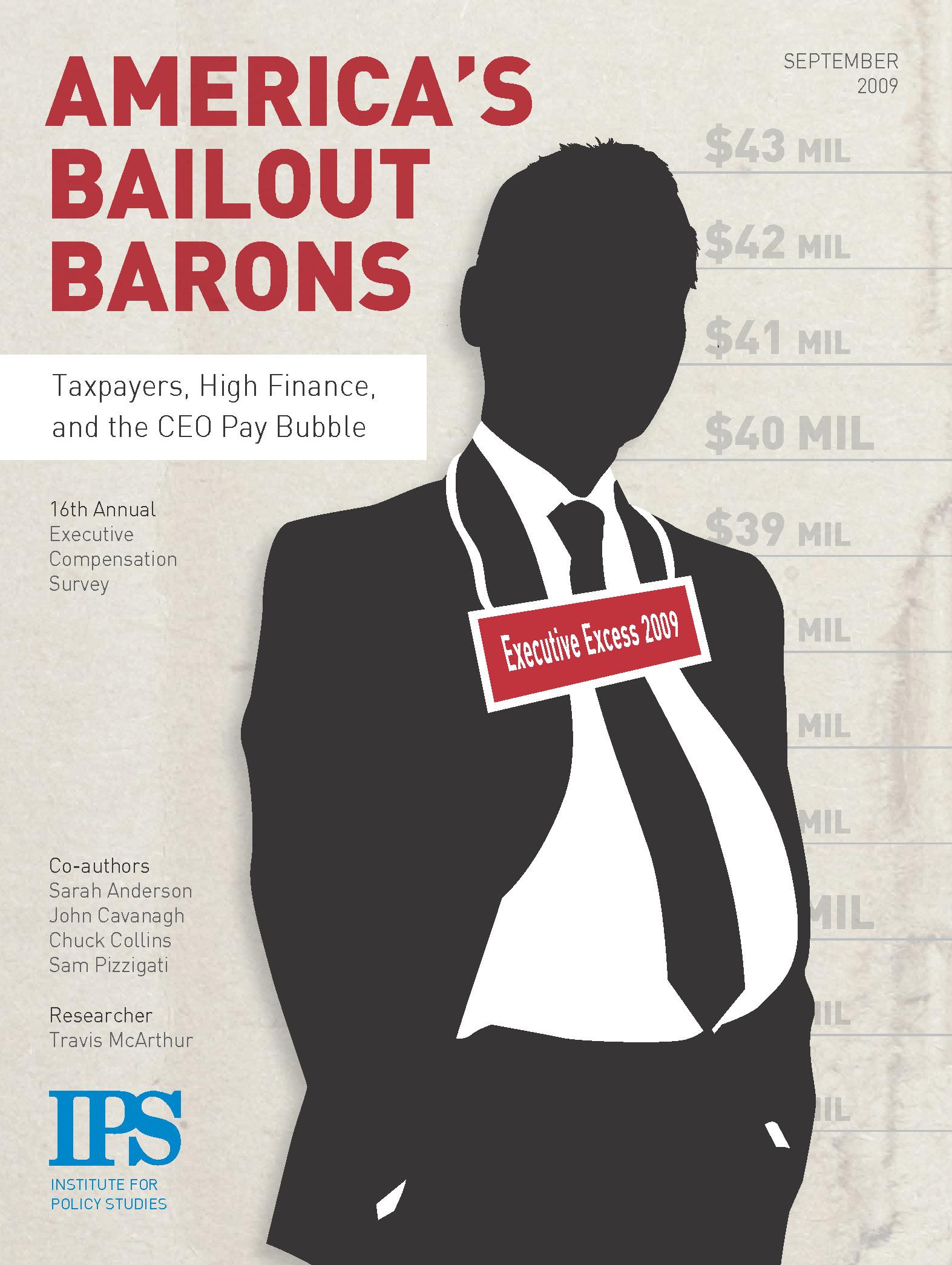

The 16th annual Institute for Policy Studies “Executive Excess” report exposes this year’s windfalls for top financial bailout recipients.

Outrageously large rewards for executives give executives an incentive to behave outrageously — and engage in behaviors that put the rest of us at risk.

Many taxpayer subsidies for executive excess have not yet hit the headlines.

This memo summarizes the key provisions in the stimulus legislation to restrict compensation for executives of bailed-out companies.