House Speaker Paul Ryan is proposing to cut the statutory federal corporate tax rate from 35 to 20 percent. President Trump wants to slash the rate even further, to just 15 percent. Their core argument? Lowering the tax burden will lead to more and better jobs.

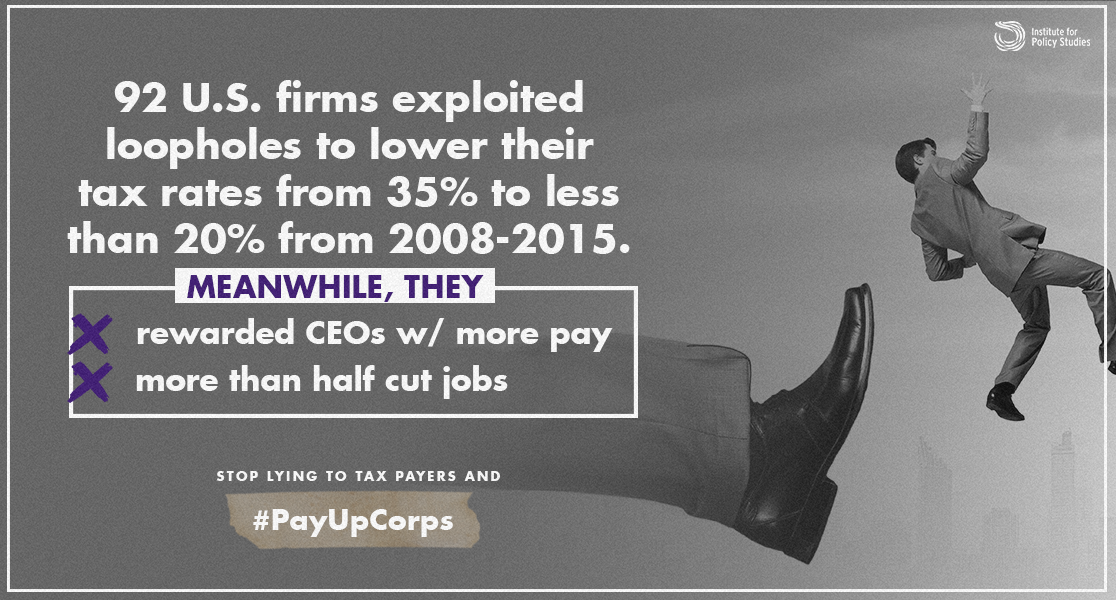

To investigate this claim, this report is the first to analyze the job creation records of the 92 publicly held U.S. corporations that reported a U.S. profit every year from 2008 through 2015 and paid less than 20 percent of these earnings in federal income tax. Did these reduced tax rates actually lead to greater employment within the 92 firms? The data we have compiled give a definitive — and sobering — answer.

Key findings:

Tax breaks did not spur job creation

- America’s 92 most consistently profitable tax-dodging firms registered median jobgrowth of negative 1 percent between 2008 and 2016. The job growth rate over those same years among U.S. private sector firms as a whole: 6 percent.

- More than half of the 92 tax-avoiders, 48 firms in all, eliminated jobs between 2008 and 2016, downsizing by a combined total of 483,000 positions.

Tax-dodging corporations paid their CEOs more than other big firms

- Average CEO pay among the 92 firms rose 18 percent, to $13.4 million in real terms, between 2008 and 2016, compared to a 13 percent increase among S&P 500 CEOs. U.S. private sector worker pay increased by only 4 percent during this period.

- CEOs at the 48 job-slashing companies within our 92-firm sample pocketed even larger paychecks. In 2016 they made $14.9 million on average, 14 percent more than the $13.1 million for typical S&P 500 CEOs.

Job-cutting firms spent tax savings on buybacks, which inflated CEO pay

- Many of the firms in our sample funneled tax savings into stock buybacks, a financial maneuver that inflates the value of executive stock-based pay. On average, the top 10 job-cutters in our sample each spent $45 billion over the last nine years repurchasing their own stock, six times as much as the S&P 500 corporate average.

ExxonMobil hiked CEO Tillerson’s pay while dodging taxes, slashing jobs

- The oil giant paid an effective tax rate of only 13.6 percent during the 2008-2015 period, at the same time cutting more than a third of its global workforce (the company does not reveal U.S. jobs data). After pumping nearly $146 billion into stock buybacks, Exxon CEO Rex Tillerson, now the U.S. secretary of state, took home $27.4 million in total compensation in 2016, 22 percent more than he collected in 2008.

AT&T is the top job-cutter among the tax-dodging firms

- The telecommunications giant managed to get away with an effective tax rate of just 8.1 percent over the 2008-2015 period, while cutting more jobs than any other firm in our sample. After accounting for acquisitions and spinoffs, the firm had nearly 80,000 fewer employees in 2016 than in 2008. Instead of job-preserving investments, the firm shoveled profits into stock buybacks ($34 billion over the past nine years) and CEO pay. AT&T chief Randall Stephenson pulled in $28.4 million in 2016, more than double his 2008 payout.

GE cut jobs while funneling offshore tax-dodging proceeds into CEO pay and buybacks

- Through extensive use of overseas tax havens, General Electric achieved a negative effective tax rate during the 2008-2015 period, meaning the firm got more back from Uncle Sam than it paid into federal coffers. The company spent $42 billion repurchasing its own stock, which helped boost CEO Jeffrey Immelt’s pay to nearly $18 million in 2016. Meanwhile, the company’s employee count dropped by about 14,700 over the past nine years.

Read the full report here [PDF].

Find shareable graphics here.

Explore all Executive Excess reports from 1994 onward.