Program on Inequality and the Common Good

Extreme inequalities of income, wealth and opportunity undercut democracy, social solidarity and mobility, economic stability, and many other aspects of our personal and public lives. The Program on Inequality and the Common Good focuses on these and other dangers that income disparities pose for the U.S.

Through research and reporting, this program encourages policy interventions that can reduce extreme wealth inequality, and close the growing gap between the rich and poor. Recent reports have examined the estate tax, the racial wealth gap, inequality in philanthropy, and other topics related to extreme wealth concentration. The central theme of the program is that without significant reform and a systemic view of inequality on both a national and global level, the overall wealth divide will continue to grow exponentially.

Latest Work

Who Wants to Be a Trillionaire?

The Donor Revolt for Charity Reform

REPORT: Who Is Lobbying against Common-Sense Charity Reform?

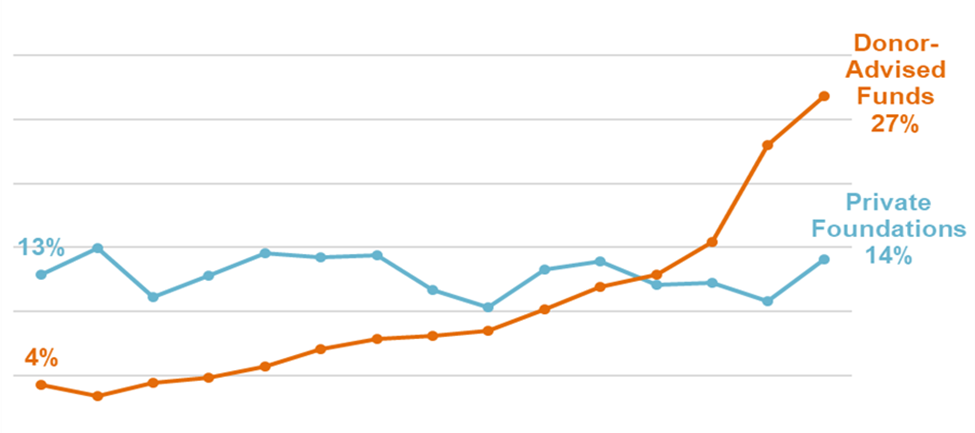

Tax Rules, Investment Houses, and Donor-Advised Funds: What’s at Stake?

Billionaire Wealth Is Soaring. We Need Progressive Taxation Now.

New Poll, Old News: Philanthropy Lobby Is Still Out of Step with Public Opinion on Charity Reform

National Donor-Advised Funds Are Hiding Behind Donation Processors to Make Themselves Look Better

Total U.S. Billionaire Wealth: Up 88% over Four Years

What Are Donor-Advised Funds and How Do They Work?

A Super Bowl Note to Taylor Swift: Love the Music, Park the Private Jet

Foundation-to-DAF Conversions: Is It a Thing?

Ranting Billionaire Makes Unwitting Case for Charity Reform

The Richest 1 Percent Own a Greater Share of the Stock Market Than Ever Before

As Elites Gather in Davos, They Can't Ignore Ignore That Most High Net-Worth Individuals Like Me Want to Pay More in Taxes

A Working Class Victory on Colombia’s Horizon

The Future of Reparations and Economic Equality

Donor-Advised Funds Now Consume a Quarter of Individual Charitable Giving

Say Hello to The Charity Reformer

VIDEO: How Wealthy Donors Warehouse Charitable Funds "for Generations"

Revealing the True Cost of Billionaire Philanthropy

View more >