During the political party convention season that begins this week, you won’t hear much disagreement on one issue: executive pay.

During the political party convention season that begins this week, you won’t hear much disagreement on one issue: executive pay.

Politicians from both parties finally appear to be seeing which way the wind is blowing on this one. Last year, a Financial Times/Harris poll revealed that 77 percent of Americans think chief executives “earn too much.” And that sentiment has likely intensified in 2008, with one banker after another walking away from the mortgage mess with overflowing pockets.

The presidential candidates have responded to public outrage over bloated CEO pay by promising to boost shareholder power over executive pay packages. Barack Obama is the sponsor of a Senate bill that would grant shareholders a nonbinding advisory vote each year. John McCain has suggested he’d like shareholders to have veto power.

This reform, widely known as “say on pay,” could shame some boards away from offering truly obscene pay packages. But when shame goes up against corporate greed, we all know which one usually prevails.

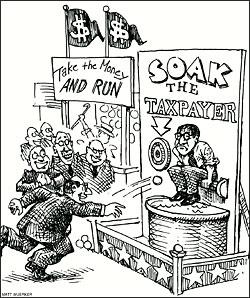

The candidates should be giving more attention to proposals that focus on eliminating the various tax loopholes that currently subsidize excessive executive pay.

Obama is supporting a fix for just one of these, the “carried interest” loophole. This is the one that lets buyout kings like KKR’s Henry Kravis (personal net worth: $5.5 billion) pay a lower tax rate than their secretaries. Private equity managers get away with this by claiming the profit share portion of their compensation as capital gains, a neat maneuver that cuts their tax bill from 35 percent to 15 percent.

When financial royalty like Kravis don’t pay their fair share, the rest of us common taxpayers get stuck with the bill. The annual cost of that particular loophole: $2.7 billion, according to Congress’s Joint Committee on Taxation.

And that’s just one of numerous tax loopholes that shift the financial burden for our country’s infrastructure, education and other needs from the ultrarich to the middle class.

According to a new report by my organization, the Institute for Policy Studies, and United for a Fair Economy, average U.S. taxpayers subsidize executive compensation to the tune of more than $20 billion per year.

Other beneficiaries include guys like Kenneth Griffin, the head of Citadel Investment Group, who made $1.5 billion in 2007. Like most hedge funds, Citadel has a subsidiary in a tax haven, in this case, Bermuda. Such offshore investment vehicles make ideal locations for fund managers to stash boatloads of money in tax-deferred accounts.

While ordinary Americans have strict limits on how much they can set aside in 401(k) plans, hedge fund executives can funnel unlimited amounts into these offshore pots, where their dollars grow and grow, untaxed, until they start withdrawing from them.

Congressional research shows that this widespread tax avoidance scheme costs taxpayers more than $2 billion annually.

Griffin hasn’t revealed how much he personally might have shielded from the IRS through his offshore subsidiary, but the multibillionaire admits that his work ethic would whither without low taxes. “I am proud to be an American,” he told the New York Times last year. “But if the tax became too high, as a matter of principle, I would not be working this hard.”

To defend their preferential tax treatment, Griffin, Kravis and other magnates have dispatched armies of lobbyists to Capitol Hill. Griffin is also hedging his political bets, hosting fundraisers for both presidential candidates and acting as a “bundler” to collect more than $50,000 for each.

So far, their “Save our Subsidies” campaign is working. The five key bills to plug executive-friendly tax loopholes are all languishing. In part, this may be due to the fact that members of Congress know they would face an almost certain presidential veto. In 2009, with a new face in the White House, prospects for this legislation could change.

The bipartisan attacks on runaway pay are encouraging. But if the candidates are serious about change, they should vow to plug every single loophole that allows our tax dollars to flow into the pockets of top business leaders. Surely, in these troubled economic times, we can find better ways to spend our nation’s wealth.