Understanding the growing divide between the haves and the have-nots in a country as large as the United States is difficult to do with just anecdotal evidence and personal experience. Fortunately, we are the beneficiaries of the hard work of a number of venerable organizations who can distill complicated government data to provide this much needed analysis.

The Institute for Policy Studies is one of these organizations providing this service (check out our latest report), but we’re far from the only one. Here are three of the latest reports from other groups illuminating some of the numbers behind the growing racial gap in our nation’s lopsided economy.

The Corporation for Enterprise Development (CFED) recently released a new study, The Assets and Opportunity Scorecard, highlighting the widespread financial insecurity for American households. The report shows that families of color “are 2.1 times more likely to live below the federal poverty level and 1.7 times more likely to lack liquid savings… [and] are significantly more likely to have subprime credit scores.”

The Corporation for Enterprise Development (CFED) recently released a new study, The Assets and Opportunity Scorecard, highlighting the widespread financial insecurity for American households. The report shows that families of color “are 2.1 times more likely to live below the federal poverty level and 1.7 times more likely to lack liquid savings… [and] are significantly more likely to have subprime credit scores.”

For more on CFED’s work to close the racial wealth divide, check out their Racial Wealth Divide Initiative and new Race & Wealth Podcast.

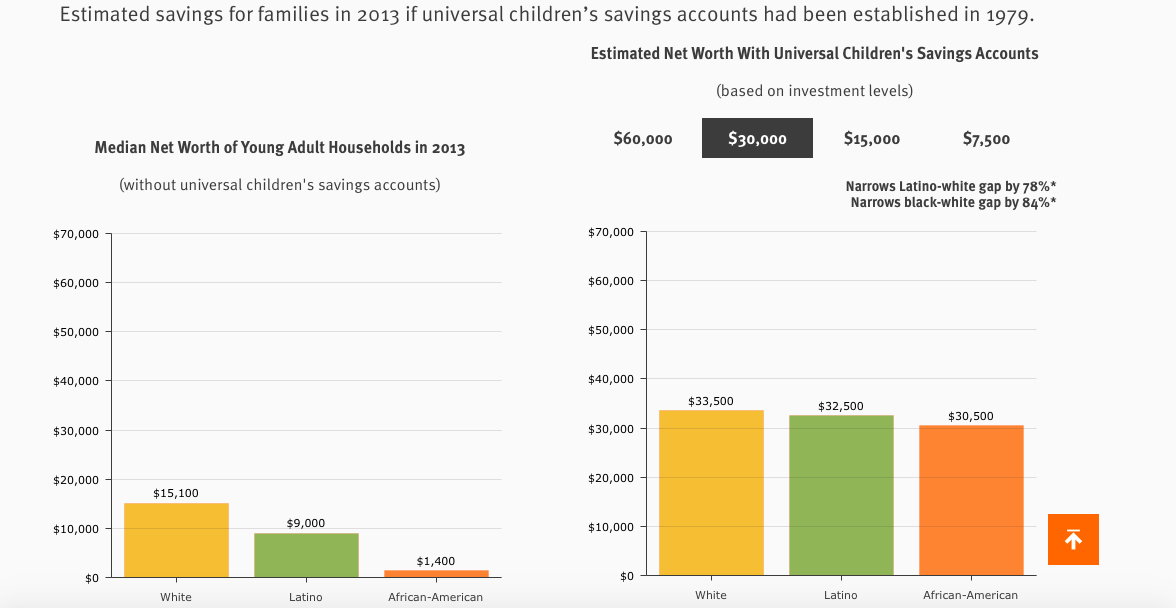

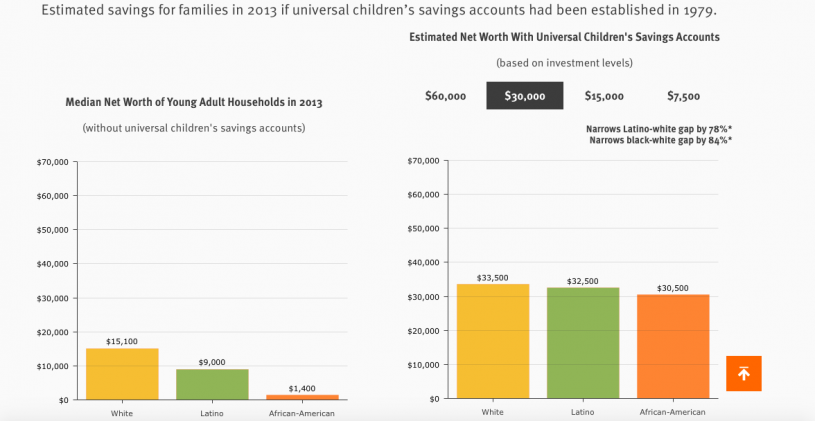

Another recent study on the racial wealth divide comes from the Annie E. Casey Foundation. Their study, Investing in Tomorrow: Helping Families Build Savings and Assets, looks at a number of interventions that would reduce the racial wealth divide.

Perhaps most interesting is a historical look at what would have happened had Child Savings Accounts been introduced in 1979. Adequately funded, Child Savings Accounts could have reduced the racial wealth gap by 80 percent, nearly eliminating it completely!

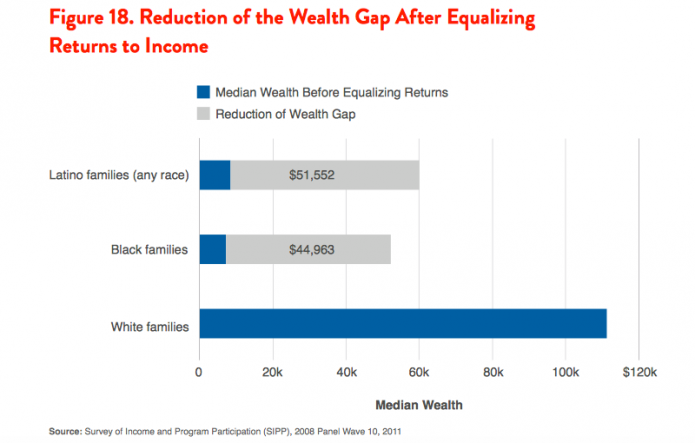

Finally, a report from the Institute on Assets and Social Policy in collaboration with Demos looks at the systemic drivers of the racial wealth divide. The report, The Racial Wealth Divide: Why Policy Matters, utilizes their Racial Wealth Audit to look at the impact of public policy on reducing the racial gap.

According to the report, the biggest drivers of the racial wealth divide are not the racial disparities in underlying financial indicators—income, homeownership, college education—but the return on these things, the racial disparity in their ability to generate wealth.

For instance, eliminating the racial disparities in income would reduce the black-white gap by 11 percent. However, eliminating the disparity in the return on income, so that Black households got the same dollar in wealth for every new dollar income that white households receive, would reduce the racial wealth divide by 43 percent. Their conclusion for lawmakers is clear: it’s more important to look at the systemic drivers of the racial wealth divide than the individual factors.

This is far from an exhaustive list of recent reports on the racial wealth divide. Much more work is being done in this field and more detail are packed into these three reports than I have space to include here. Check back often to inequality.org for updates on the latest trends in inequality research and action.