No two corporations follow the same exact tax-dodging strategies. To give a sense of the breadth of corporate tax-avoiding creativity, we are spotlighting a choice selection of the nation’s most aggressive corporate tax avoiders.

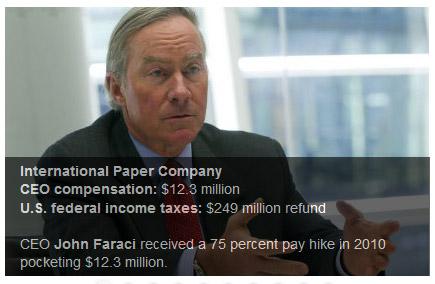

International Paper Company

Turning a tax boondoggle into personal gold

CEO compensation: $12.3 million

U.S. federal income taxes: $249 million refund

International Paper CEO John Faraci received a 75 percent pay hike in 2010. He pocketed $12.3 million.

Faraci owes his good fortune, in large part, to a wood pulp byproduct called “black liquor.” Paper mills have been using this byproduct as a fuel since the 1930s. But that didn’t stop International Paper from lobbying in Washington to have “black liquor” earmarked for subsidies and federal tax refunds designed to spur the development of entirely new biofuels.That lobbying would be successful — for International Paper.

How much has the company garnered from twisting the intent of the alternative fuel incentive? In 2009, this twisting handed the company a whopping $1.7 billion in cash and cut the International Paper tax bill by another $379 million. This windfall added up to nearly 9 percent of the firm’s annual global revenue. Last year, International Paper reported still another net $40 million tax benefit from the biofuel credit.

International Paper’s corporate board, naturally, cited the company’s strong cash flow as a rationale for Faraci’s generous compensation package.

Outraged? Sign our petition and share with your friends below.