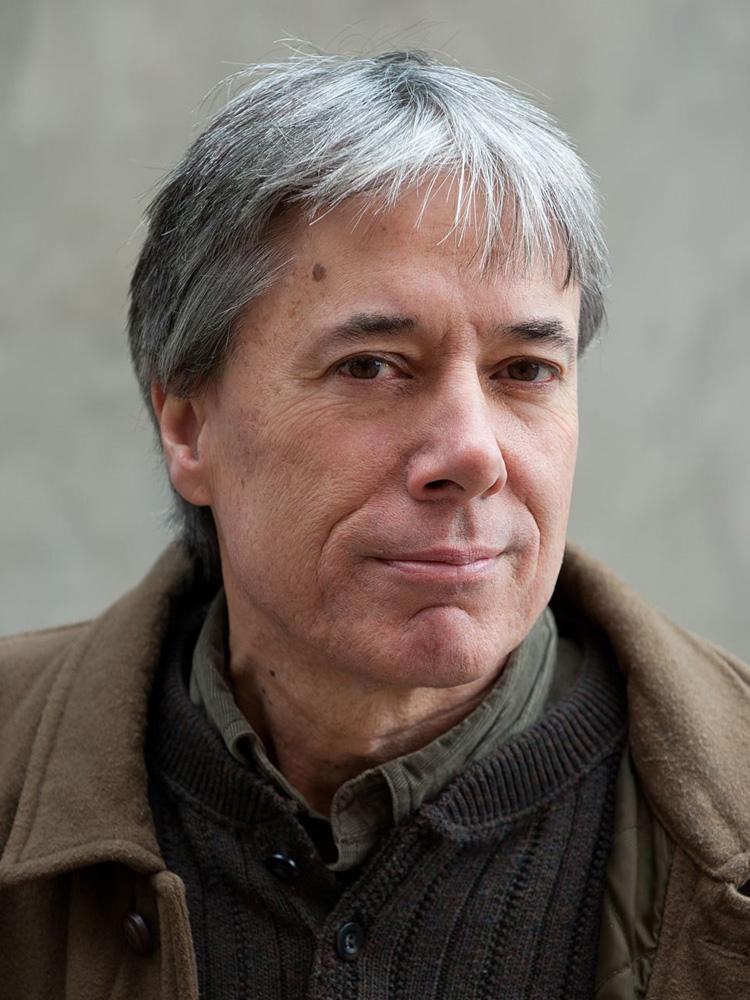

Chuck Collins is the Director of the Program on Inequality and the Common Good at the Institute for Policy Studies, where he co-edits Inequality.org.

He is an expert on U.S. inequality and the racial wealth divide and author of over ten books and dozens of reports about inequality, climate disruption, philanthropy, the racial wealth divide, affordable housing, and billionaire wealth dynasties.

His newest book is a novel, Altar to an Erupting Sun (Green Writers Press), a near-future story of one community facing climate disruption in the critical decade ahead. See more at www.chuckcollinswrites.com.

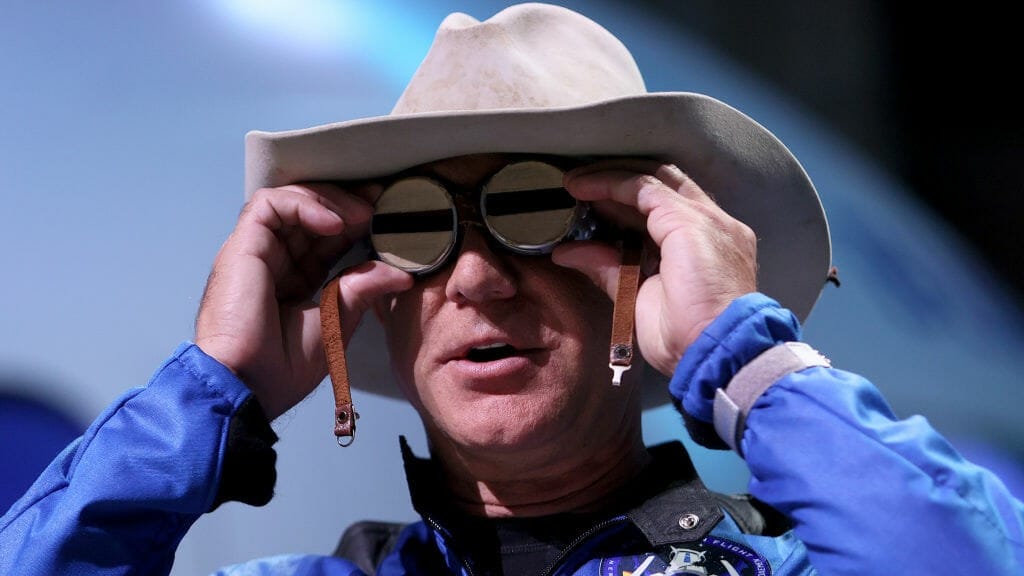

His 2021 book, The Wealth Hoarders: How Billionaires Spend Millions to Hide Trillions (Polity Books), unmasks the industry of professional enablers that assist the ultra-wealthy to hide wealth and dodge taxes.

He is author of the popular book, Born on Third Base: A One Percenter Makes the Case for Tackling Inequality, Bringing Wealth Home, and Committing to the Common Good (Chelsea Green); He is co-author, with the late Bill Gates Sr. of Wealth and Our Commonwealth, (Beacon Press, 2003), a case for taxing inherited fortunes. He is co-author with Mary Wright of The Moral Measure of the Economy, a book about Christian ethics and economic life. He was featured in this interview in Sun Magazine and with Terry Gross on NPR’s Fresh Air.

He is co-author of several IPS reports including:

- “White Supremacy Is the Pre-Existing Condition: Eight Solutions to Ensure the Economic Recovery Reduces the Racial Wealth Divide“

- Gilded Giving 2022: How Wealth Inequality Disrupts Philanthropy and Imperils Democracy

- “Billionaire Enabler States: How U.S. States Captured by the Trust Industry Help the World’s Wealthy Hide Their Fortunes (2022)

- Silver Spoon Oligarchs: How America’s 50 Largest Inherited Wealth Dynasties Accelerate Inequality (2021)

- “Billionaire Bonanza 2020: Wealth Windfalls, Tumbling Taxes, and Pandemic Profiteers.”

He is a founding member of the Patriotic Millionaires. In 1995, he co-founded United for a Fair Economy (UFE) to raise the profile of the inequality issue and support popular education and organizing efforts to address inequality. He was Executive Director of UFE from 1995-2001 and Program Director until 2005.

See an archive of Chuck’s writing, videos and commentaries. For media inquiries, contact Olivia Alperstein at olivia@ips-dc.org. For public speaking inquiries, contact Jodi Solomon Speakers Bureau.