This report reveals stark indicators of the extent to which large corporations are avoiding their fair share of taxes.

Of America’s 30 largest corporations, seven (23 percent) paid their CEOs more than they paid in federal income taxes last year.

- All seven of these firms were highly profitable, collectively reporting more than $74 billion in U.S. pre-tax profits. However, they received a combined total of $1.9 billion in refunds from the IRS.

- The seven CEOs leading these tax-dodging corporations were paid $17.3 million on average in 2013. Boeing and Ford Motors both paid their CEOs more than $23 million last year while receiving large tax refunds.

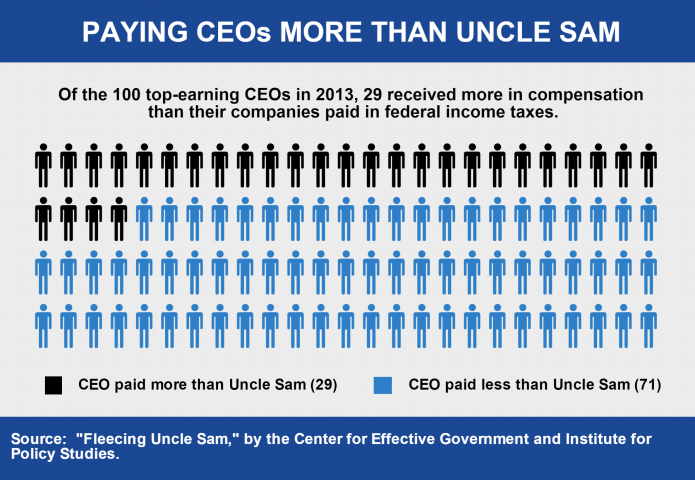

Of America’s 100 highest-paid CEOs, 29 received more in pay last year than their company paid in federal income taxes—up from 25 out of the top 100 in our 2010 and 2011 surveys.

- These 29 CEOs made $32 million on average last year. Their corporations reported $24 billion in U.S. pre-tax profits and yet, as a group, claimed $238 million in tax refunds.

- Combined, the 29 companies operate 237 subsidiaries in tax havens. The company with the most subsidiaries in tax havens was Abbott Laboratories, with 79. The pharmaceutical firm’s CEO paycheck was $4 million larger than its IRS bill in 2013.

For corporations to reward one individual, no matter how talented, more than they are contributing to the cost of all the public services needed for business success reflects the deep flaws in our corporate tax system. Rather than more tax breaks, Congress should focus on addressing these deep flaws by cracking down on the use of tax havens, eliminating wasteful corporate subsidies, and closing loopholes that encourage excessive executive compensation.