Wall Street banks handed out $28.5 billion in bonuses to their 167,800 employees last year, up 3 percent over 2013, according to new figures from the New York State Comptroller. These annual bonuses are an extra reward on top of base salaries in the securities industry, which averaged $190,970 in 2013.

Wall Street banks handed out $28.5 billion in bonuses to their 167,800 employees last year, up 3 percent over 2013, according to new figures from the New York State Comptroller. These annual bonuses are an extra reward on top of base salaries in the securities industry, which averaged $190,970 in 2013.

To put these figures in perspective, we’ve compared the Wall Street payout to low-wage workers’ earnings. We’ve also calculated how much more of a national economic boost would be gained if similar sums were funneled into the pockets of the millions of workers on the bottom end of the pay scale.

For full sources and methodology, download the full report [PDF].

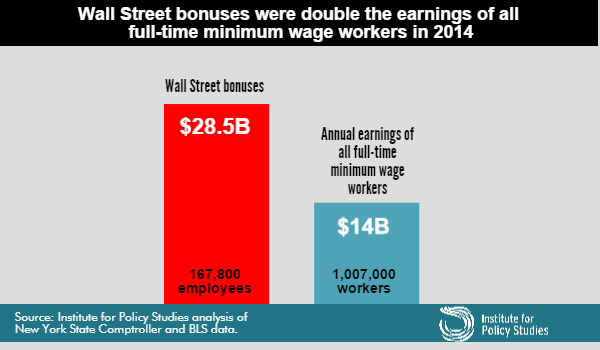

Wall Street Bonuses v. Minimum Wage Earners

The $28.5 billion in bonuses doled out to Wall Street employees is double the annual pay for all 1,007,000 Americans who work full-time at the current federal minimum wage of $7.25 per hour. Wall Street bonuses rose 3 percent last year, despite a 4.5 percent decline in industry profits. The size of the bonus pool was 27% higher than in 2009, the last time Congress increased the minimum wage.

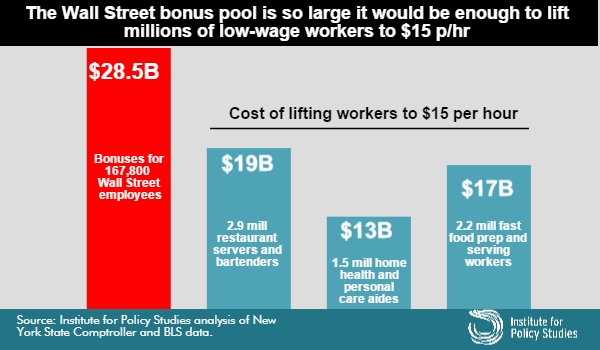

Wall Street Bonuses v. Low-Wage Service Workers

Wall Street’s bonus culture, we learned from the 2008 financial industry meltdown, creates an incentive for high-risk behaviors that endanger the entire economy. A large share of low-wage earners, on the other hand, spend every workday meeting basic human needs, such as providing food services and taking care of the disabled and elderly.

Low-wage workers in many sectors have united around a call for “one fair wage” of a minimum of $15 per hour. A few cities, including Seattle and San Francisco, have already adopted $15 minimum wages. While this is more than double the current federal minimum wage of $7.25, the size of the Wall Street bonus pool puts these figures in perspective.

The bonus pool is so large it would be far more than enough to lift all 2.9 million restaurant servers and bartenders, all 1.5 million home health and personal care aides, or all 2.2 million fast food preparation and serving workers up to $15 per hour.

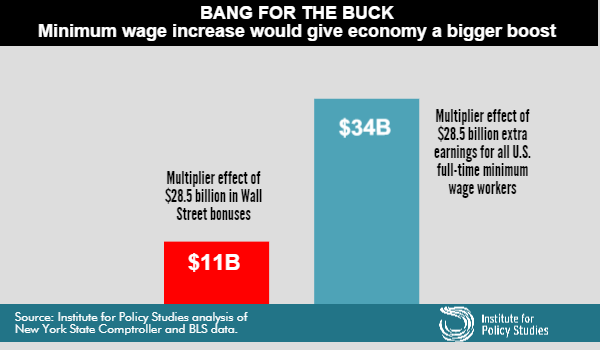

Wage Increases Would Create Bigger Bang for the National Buck

Wall Street bonus season may coincide with an uptick in luxury goods sales, but a raise in the minimum wage would give America’s economy a much greater boost. To meet basic needs, low-wage workers tend to spend nearly every dollar they make. The wealthy can afford to squirrel away more of their earnings.

All those dollars low-wage workers spend create an economic ripple effect. Based on standard fiscal multipliers established by Moody’s Analytics, every extra dollar going into the pockets of a high-income American only adds about $0.39 to the GDP. By contrast, every extra dollar going into the pockets of low-wage workers adds about $1.21 to the national economy.

These pennies add up considerably on $28.5 billion in earnings. If the $28.5 billion Wall Streeters pulled in on bonuses in 2014 had gone to minimum wage workers instead, our GDP would have grown by about $34.5 billion, over triple the $11.1 billion boost expected from the Wall Street bonuses.

Wall Street Bonus Reform is Long Overdue

While workers’ wages stagnate, the Wall Street bonus culture is flourishing—in part because of regulatory foot-dragging. Nearly five years after the Dodd-Frank financial reform was signed into law, regulators have still not implemented Section 956 of that law, which prohibits financial industry pay packages that encourage “inappropriate risks.”

The proposal regulators released in 2011 ignores key lessons from the last half-dozen years of financial scandals. It would only apply pay restrictions to top executives, leaving off the hook traders and other employees whose activities could put the financial system at risk. The only specific pay restriction relates to the timing of bonuses. Bankers would have to wait three years to collect half of their annual bonuses, which doesn’t amount to much of a disincentive to short-term recklessness.

The European Union now limits bonuses for key bank staff to no more than 100% of their base salaries, or up to 200% with shareholders’ approval. Americans for Financial Reform has put forward detailed proposals for strengthening the proposed U.S. regulation.

For full sources and methodology, download the full report [PDF].