While workers’ wages stagnate, the Wall Street bonus culture is flourishing.

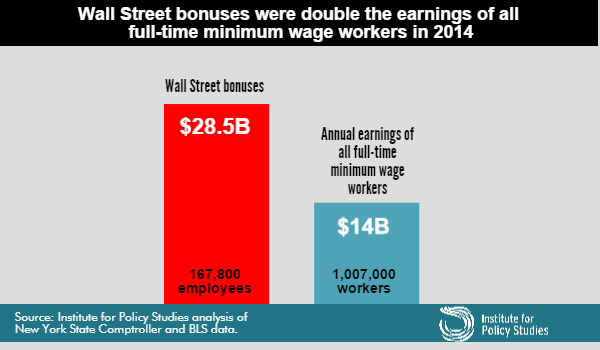

New figures from the New York State Comptroller reveal that Wall Street banks handed out $28.5 billion in bonuses to their 167,800 employees last year. That’s nearly double the combined annual earnings of the more than 1 million full-time U.S. minimum wage workers, according to a report I authored for the Institute for Policy Studies.

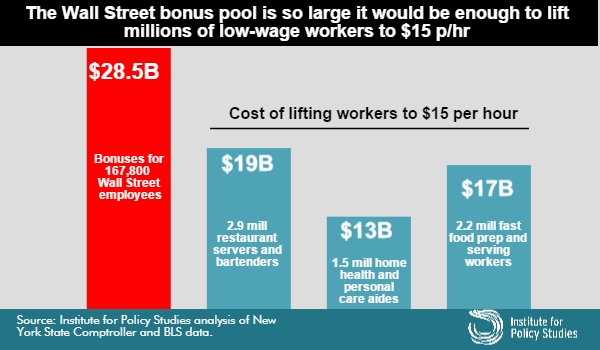

Low-wage workers across multiple sectors are demanding a raise in the minimum wage to $15 per hour and are organizing “Fight for $15” actions around the country on April 15. While $15 is more than double the current federal minimum of $7.25, the size of the Wall Street bonus pool puts these figures in perspective.

Consider this: the bonus pool is so large it would be far more than enough to lift all 2.9 million restaurant servers and bartenders, all 1.5 million home health and personal care aides, or all 2.2 million fast food preparation and serving workers up to $15 per hour.

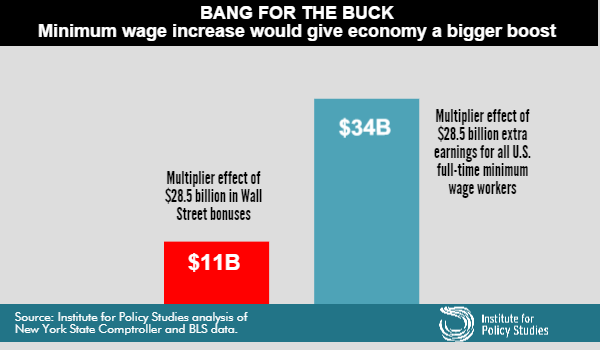

While millions of low-wage workers are taking care of our basic human needs, Wall Streeters continue to be rewarded for high-risk behaviors that endanger the entire economy. And that’s not the only price we pay for our lopsided compensation system. Because the very rich squirrel away much of their income, their gigantic bonuses don’t have nearly the stimulus effect as raising pay for low-wage workers who have to spend nearly every dollar they make.

Based on standard fiscal multipliers, if the $28.5 billion in Wall Street bonuses had gone to minimum wage workers instead, our GDP would be expected to grow by about $34 billion, over triple the $11 billion boost expected from the Wall Street bonuses.

What can be done? Well, on top of raising the minimum wage, it would be nice if regulators would stop dragging their feet and finally implement modest Wall Street pay reforms in the Dodd-Frank financial reform legislation. For nearly five years now they have stalled the part of that law that prohibits financial industry pay packages that encourage “inappropriate risks.”

In 2011, regulators issued a wimpy proposal that ignores key lessons from the last half-dozen years of financial scandals. It leaves off the hook traders and other non-executive employees whose activities could put the financial system at risk. And for the top brass, the only restriction is that they would have to wait three years to collect half their annual bonuses. Americans for Financial Reform has put forward detailed proposals for strengthening the regulation.

We don’t know yet whether last year’s Wall Street bonuses were based on high-risk gambles that could eventually ruin our economy. What is clear is that we’re unfairly rewarding the people whose work we couldn’t do without, such as feeding us and taking care of our disabled and elderly.